2nd Solved assighnment - code 438 aiou Autumn 2019

ASSIGNMENT

No. 2

(Units 5–9)

Total Marks: 100

Pass Marks: 50

Q. 1 Akwash

&Co. keeps his books by

single entry system. He gives you the financial information from which you are

required to ascertain his profit or loss during 2018.

Jan.1, 2018 Dec.31, 2018

Cash in hand 100,000 80,000

Sundry debtor 157,500 200,000

Furniture 100,000 100, 000

Building 200,000 196,000

Plant & machinery 75,000 72,500

Overdraft in Bank 80,000 65,200

Sundry Creditor 130,600 140,500

During

the year Akwash & Co. had withdrew Rs.30, 000. He brought the money Rs. 25,000 in to

business on 1-7-2018. (20)

Ascertain

the profit or loss made by him after considering the following adjustment.

i.

Depreciation on Furniture @ 10% p. a.

ii.

Charge Interest on Capital @5% p .a.

iii.

Write off Rs. 5000 From Sundry Debtor.

Requirement;

Prepare A Statement of Profit and Loss.

Q. 2 From

the following Receipt & Payment account of Students Foundation and the

subjoined information Prepare the income and Expenditures account for the year

ended 31st December 2018 and a Balance Sheet as on that date from it

and subjoined information. (20)

Date

|

Receipt

|

Amount

|

Date

|

Expenditure

|

Amount

|

2018

|

Endowment fund

Donations

Subscription

Legacies’

Miscellaneous

fees

Interest on

Investment

Interest on

deposit

|

14,460

20,720

8,020

10,000

3,600

3,680

600

|

2018

|

Payment of

salaries

Rent (31-3-2019)

Office

expenses

Commission

Printing

Postage

Purchase of

Govt. securities

Balance of c/d

|

15,300

1,200

5,700

940

720

560

80,00

28,660

|

Total

|

61,080

|

Total

|

61,080

|

Additional

Information

i.

The legacies and donations are capitalized.

ii.

A quarter’s rent is prepaid which amount is Rs.300

full yearly charges of rent is Rs. 1,200.

iii.

Subscription is outstanding for 2013 RS. 500.

iv.

Interest on Government securities Rs.800 had accrued

but was not received.

v.

Postage Rs.240 is outstanding :

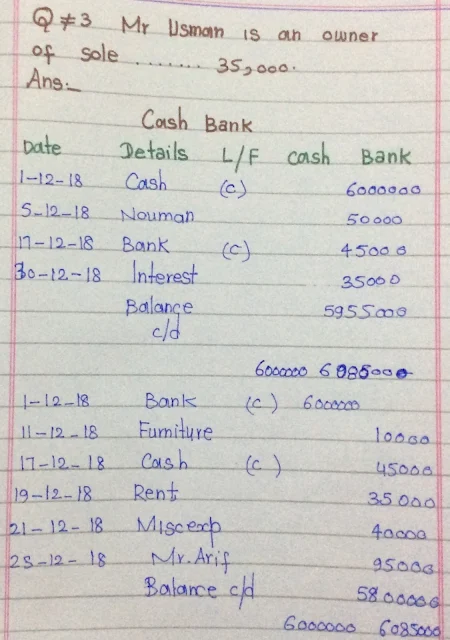

Q. 3 Mr.

Usman is an owner of sole proprietorship business. During the month of December 2018, he opened

a current account with Allied Bank Ltd. following transactions were recorded

you are required to enter the transaction in cash Book and in the pass book. (20)

2018.

December 1. Mr. Zahid opened current account with Allied

Bank Ltd. for Rs. 6,000,000.

December 5. A cheque received from Noman Rs.50, 000 and

deposited into bank same day

December

11. Purchased furniture Rs. 70,000 paid

by Cheque.

December

17. Cash drew from bank for office use

Rs. 45,000.

December

19. Paid rent by chequeRs. 35,000.

December

21. Misc. expense debited by bank Rs.

40,000

December

25. Purchased goods from Mr. Asfer paid

by cheque Rs. 95,000.

December

30. Interest received from bank Rs.

35,000.

Q.4 State

with reasons whether the following items should be classified as” Capital or

Revenue” expenditure: (20)

a)

Wages paid on erection of machinery.

b)

Repair of machinery for keeping it in

working condition.

c)

Brokerage and stamp duty on purchase of

building.

d)

Interest paid on loan during construction of a

plant.

e)

Amount incurred for providing uniform to

staff.

f)

Annual fee paid for renewal of patents.

g)

Loss

arising from sale of fixed assets.

h)

Book

value of assets discarded or totally damaged or destroyed by fire.

i)

Cost of goodwill.

j)

Actual additions and extension to existing

plant.

a)

The sales book has been under-cast by

Rs.8, 000.

b)

A cheque drawn for wages for Rs.1, 500

was wrongly posted to wages A/c as Rs.1, 400.

c)

Furniture purchased for Rs.1, 040 has

been debited to purchase A/c as Rs. 1,640.

d)

Rs. 550 received from Rahim debited to

his account.

e)

Discount received Rs. 200 was posted to

the wrong side of Discount A/C

f)

Rs 7,000 paid in cash for a typewriter

was charged to office expenses account

g)

Q:1

AUTUMN 2019 SOLVED ASSIGNMENTS

For autumn 2019 assignments click on this link Solved assignments autumn 2019 aiou all code |

Post a Comment