1st Solved assighnment - code 438 aiou Autumn 2019

Course: Principles of Accounting (438) Semester: Autumn, 2019

Level: Bachelor/B.A/B.Com (Renamed as Associate Degree 2 Year) Total Marks: 100

Pass Marks: 50

ASSIGNMENT No. 1

(Units 1–4)

Q. 1 i. Define Accounting and describe its branches. (10+10=20)

ii. Demonstrate how certain business transactions affect the elements of the accounting equation: assets= Liabilities + Owner’s Equity.

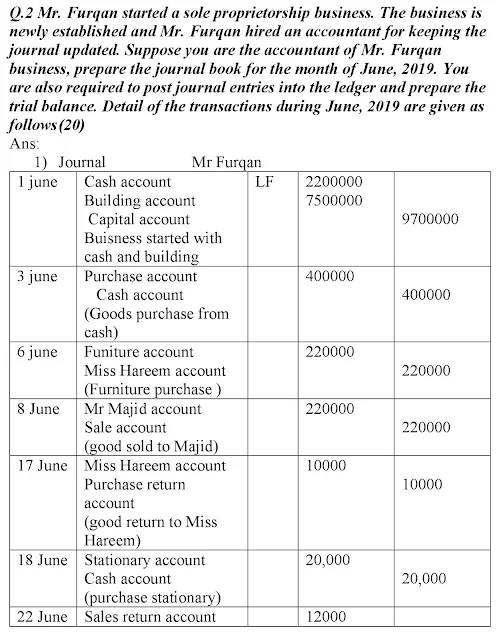

Q. 2 Mr. Furqan started a sole proprietorship business. The business is newly established and Mr. Furqan hired an accountant for keeping the journal updated. Suppose you are the accountant of Mr. Furqan business, prepare the journal book for the month of June, 2019. You are also required to post journal entries into the ledger and prepare the trial balance. Detail of the transactions during June, 2019 are given as follows (20)

June .1. Mr. Furqan commenced business with Cash of Rs. 2,200,000/- Building Rs.7, 500, 000/-

3. Purchased Goods with cash Rs. 400,000/-

6. Purchased furniture from Miss HareemRs.220, 000/-8. Sold goods to Mr. Majid Rs. 220,000/-

17. Goods returned to Miss HareemRs.10, 000/-

18. Stationery Purchased Rs.20, 000/-

22. Returned goods to Mr. Majid Rs.12, 000/-

28. Utility bills paid for the month Rs.70, 000/-

31. Salaries paid for the month Rs.70, 000/-

Q. 3 Define journal and also explain in detail the objectives and importance of journal in daily life of business. (20)

Ans:

Q. 4 On 1st July 2015, Zahid purchased Machinery for Rs. 600,000.

Depreciation is to be charged @10% on Straight line method and Reducing

balance method each year. On 31st October, 2017 Machinery was sold for

Rs. 140,000 as they became useless. On the same date he purchased new

machinery for Rs.200, 000.

Required: Prepare machinery Accounts from 2015 to 2018. Accounts are closed

on 31st December every year.

Ans:

Q. 5 i. Define partnership and discuss kinds of partners. (20) If the profit earned during the last five years Rs. 60,000, Rs. 62,000, Rs.61,000, Rs. 55,000 and Rs. 60,000. Calculate the value of good will, under the average profit method and 3-year purchase of the average profits of the last five year

Ans:

b) If the profit earned during the last five years Rs. 60,000, Rs. 62,000, Rs.61,000, Rs. 55,000 and Rs. 60,000. Calculate the value of good will, under the average profit method and 3-year purchase of the average profits of the last five years?

Ans:Year Profit(Rs)

1st year 60000

2nd year 62000

3rd year 61000

4rth year 55000

5th year 60000

298000

Average profit:298000 / 5 =59600

value of goodwill (being three years purchase of the average net profit for five years

596000 x3 ==178800

AUTUMN 2019 SOLVED ASSIGNMENTS

For autumn 2019 assignments click on this link Solved assignments autumn 2019 aiou all codes

Post a Comment